By: Tom Hilton | Posted: November 9, 2020 | Updated: April 5, 2023

The information in this series on scams is intended to help you reduce vulnerability to scams for both you and loved-ones like parents, grandparents, etc. The key message is that to be forewarned is to be forearmed.

Every scam victim I have ever known says something like: “I didn’t know they could do that.” And/or “They sounded so real over the phone.”

Until we ourselves or one of our loved-ones gets scammed, we probably think of scams as happening to other people; not us.

Overview

This series focuses on helping readers of all generations learn the fundamentals of scams, what scammers are after, how they use mail, email, mobile phones, tablets, and personal computers to steal your identity, your money, and even the Internet bandwidth you pay for every month to access the internet.

The information in this series on scams is intended to help you reduce vulnerability to scams for both you and loved-ones like parents, grandparents, etc. The key message is that to be forewarned is to be forearmed.

Thus, we break the series into 4 parts starting with why the elderly are prime targets for scams. The second and third parts address forewarning and being forearmed. The fourth part deals with things you can do when you must step in and directly protect highly-vulnerable family members who might be struggling with a mental or physical disability.

Table of Contents

Part 1: Scams & Older Adults. Why older people are especially vulnerable to scams – it’s not just because they are less tech-savvy than younger generations.

- Scroll down to read.

Part 2: Forewarning. How scams generally work, what their objectives may be, and ways to recognize signs and situations that increase your vulnerability.

Part 3: Forearming. Ways to reduce your vulnerability to scams and ways to help yourself and your loved-ones to remain scam-free by following some basic safety rules.

Part 4: Taking control – When you need to step in. What you can do if you need to step in directly to help a loved-one manage their affairs to avoid exploitation.

Why Are We More Vulnerable to Scams as We Age?

Research shows that there are three primary reasons why our vulnerability to scams increases as we age.

- First, as we age technology tends to outpace us.

- Second, as we age, our brains age too, and gradually it becomes more difficult to organize our thoughts and remember things – especially recent things. An aging brain often makes us too willing to trust how things (especially things that seem familiar) actually are. That often causes us to make impulsive decisions without thinking things through.

- Third, as we age our daily medications can dampen our reasoning abilities even more.

Technology Vulnerability

Younger people are first to adopt new technology, while older people continue to use older, familiar technology until it starts becoming obsolete (think dial phones and monochrome TV’s).

Most people under 40 are already proficient with the latest technology, while those over 40 are often just starting to replace their tried-n-true tech tools. There is no need to stream video from the Internet, TV still works like back in 1970, landline phones still enable you to call people, and paper mail still arrives in your mailbox – though 90% of it is now junk advertising rather than correspondence with friends and businesses.

Scammers (crooks) are constantly searching for new ways to gain access to other people’s money.

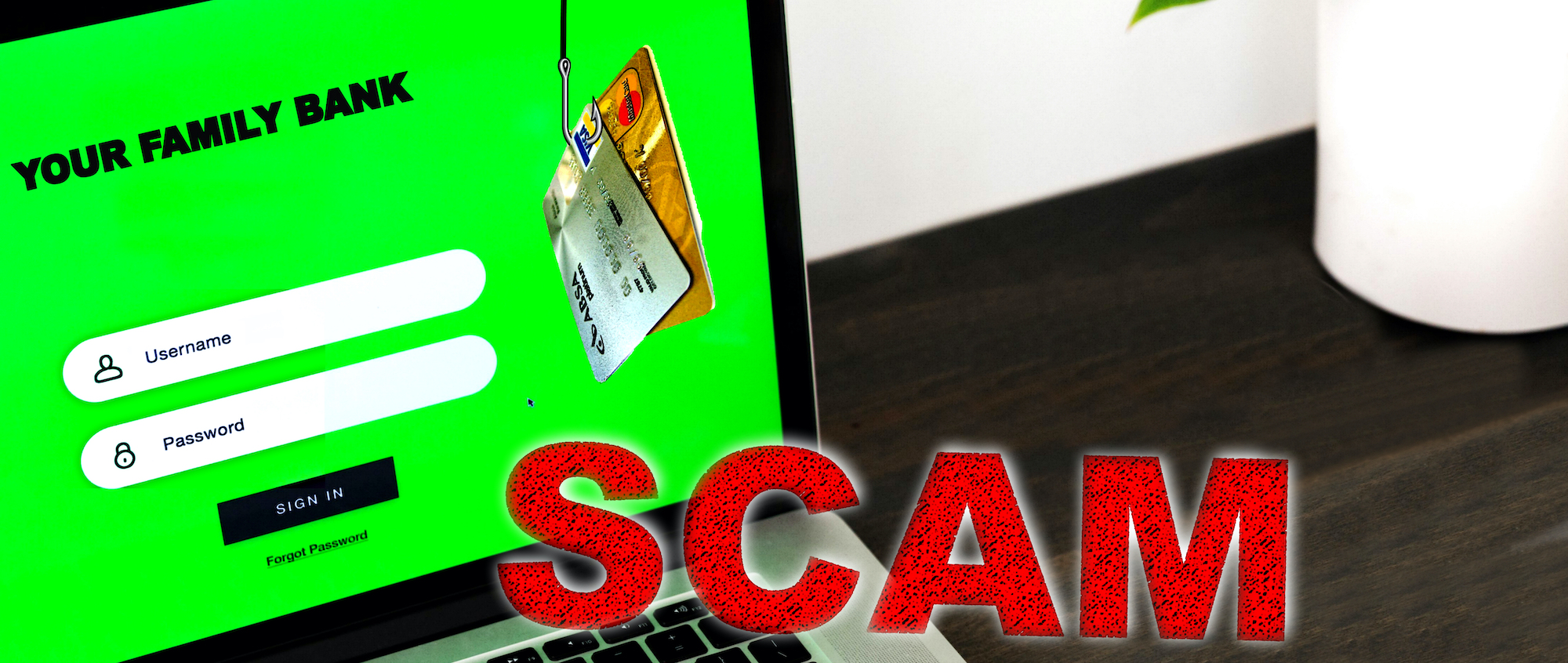

Their primary aim is to finesse us into volunteering personal information like credit card numbers, bank account numbers, passwords and personal identification numbers (PINs). With your personal information, scammers can open bank and credit accounts in your name and run up bills you are responsible for paying. With the right information, scanners can even hack (break into) your personal bank and brokerage accounts – and drain them.

Scammers get people to provide personal and financial information through a process referred to as “fishing” by luring victims into vulnerable situations via phones, websites, email or even postal mail. They spoof your smartphone to display a fake caller ID, or send a spoof email that looks like it was sent from a trusted source. Next, they lie about who they are and why they are contacting you just to get you to volunteer information that they can use to rob you later.

The marketplace is eager to sell you PCs, tablets, and smartphones that are elder-friendly as well as software/apps and online services that claim to protect older users from scams and hacks. While such products often provide increased protection from scammers, they are far from foolproof. Once on a spoof site or talking on the phone with a scammer, victims readily volunteer information because they “thought” they were providing it to their bank, a trusted service provider, or merchant.

Brain Vulnerability

The Second reason that we are more vulnerable to spoofs and scams as we age is that our bodies deteriorate – including our brains.

I don’t mean that we are losing our minds. However, just like our vision and hearing is deteriorating, so are some functions in our brains. While many people stay sharp as a tack mentally until they draw their last breath, research shows that the frontal lobes of everybody’s aging brains – that bit of gray matter behind our foreheads – starts to shrink and function less effectively. Shrinking frontal lobes will not kill us prematurely and rarely cause dementia, but the deterioration does interfere with two important functions of our brains: impulse control; and recalling and organizing information.

Our frontal lobes regulate impulse control.

That makes us more likely to act without stopping to think about things like, “Is this really my bank calling – the caller’s number appearing on my smartphone is the one I usually call?” or “Is this email really from my bank, credit card company, broker, title company, etc.?” As we age, we are are less likely to stop to think, “Why would they be asking to verify or update information over the phone that I provided when I opened my account.” or “Why did they email me to go on line and update my account via a click-here link? Don’t they think I know their web address?”

Our frontal lobes also facilitate remembering and organizing thoughts.

We do not organize our thoughts as well as we once did, and it is harder for us to store new information in our long-term memory for future retrieval when we need it. Most of us are aware that we are more forgetful, but fail to realize it is because of difficulty permanently planting information in our brains and organizing it. After all, we can easily recall the name of our 3rd-grade teacher or our 1st dog.

Medication Vulnerability

A third reason older people are more vulnerable to scams is medication – specifically drug side effects and drug-drug interactions.

A third reason older people are more vulnerable to scams is medication – specifically drug side effects and drug-drug interactions.

All drugs are neurotoxic. That’s how they help to alleviate symptoms. However, if your brain is already aging, drugs can impact cognitive processes like thinking and making sense — which may already be getting less effective as we age.

Sometimes, drug side effects can create entirely new cognitive symptoms.

When it comes to side effects caused by drug-drug interactions, many doctors might treat that as a new disease, and prescribe even more drugs. Just taking 3 drugs opens patients to 4 possible drug interactions: A+B, A+C, B+C, A+B+C. Adding a 4th drug creates 11 possible interactions: A+B, A+C, A+D, B+C, B+D, C+D, A+B+C, A+B+D, A+C+D, C+B+D, A+B+C+D. Taking 5 or more drugs is not uncommon among people over 70.

While it might be possible to stop taking some of the drugs a person is on, there is a risk that it might put their life at risk to withdraw drugs just to ensure clear thinking. That is when family might have to step in to guard against financial mismanagement and scam vulnerability.

What To Do About Scams?

So, now that you understand that we older Americans are prime targets for scammers because many of us have not mastered modern technology, our brains are not as sharp they used to be, and that our reasoning abilities can often be clouded by medication side effects; what can you do?

My answer is to take a few minutes to learn the basics of how scams generally work, how to defend against scammers, learn a few simple safety rules (and what they try to achieve), and finally, how you can step in to help thwart financial scams and mismanagement to protect a vulnerable loved-one.

Being Forewarned and Forearmed; And When to Take Control.

I have created three “companion articles” with deep dives about how to be “forewarned and forearmed”. And how to “Step in and Take Control if Needed”.

1. Forewarning involves learning how scammers and crooks try to rob you. Read “How Scams Work“.

2. Forearming includes a variety of actions you can take to reduce your or your loved-one’s vulnerability to being scammed. Read “How to Avoid Scams and Defend Against Them“.

3. When to Step In and Take Control discusses situations when you need to be more proactive. Read “Elderly Scams: When You Need to Take Control“.

*Disclosure: The research and opinions in this article are those of the author, and may or may not reflect the official views of Tech-enhanced Life.

If you use the links on this website when you buy products we write about, we may earn commissions from qualifying purchases as an Amazon Associate or other affiliate program participant. This does not affect the price you pay. We use the (modest) income to help fund our research.

In some cases, when we evaluate products and services, we ask the vendor to loan us the products we review (so we don’t need to buy them). Beyond the above, Tech-enhanced Life has no financial interest in any products or services discussed here, and this article is not sponsored by the vendor or any third party. See How we Fund our Work.